Empowering Employee Financial Well-Being: A Key to Engagement and Retention in Today’s Economy

Posted on 09-20-2024, Read Time: 6 Min

Share:

In this article, we will explore the key financial stressors affecting employees today, how these challenges manifest in the workplace, and the solutions that employers can implement to empower their workforce for financial resilience.

The Growing Financial Stress Epidemic

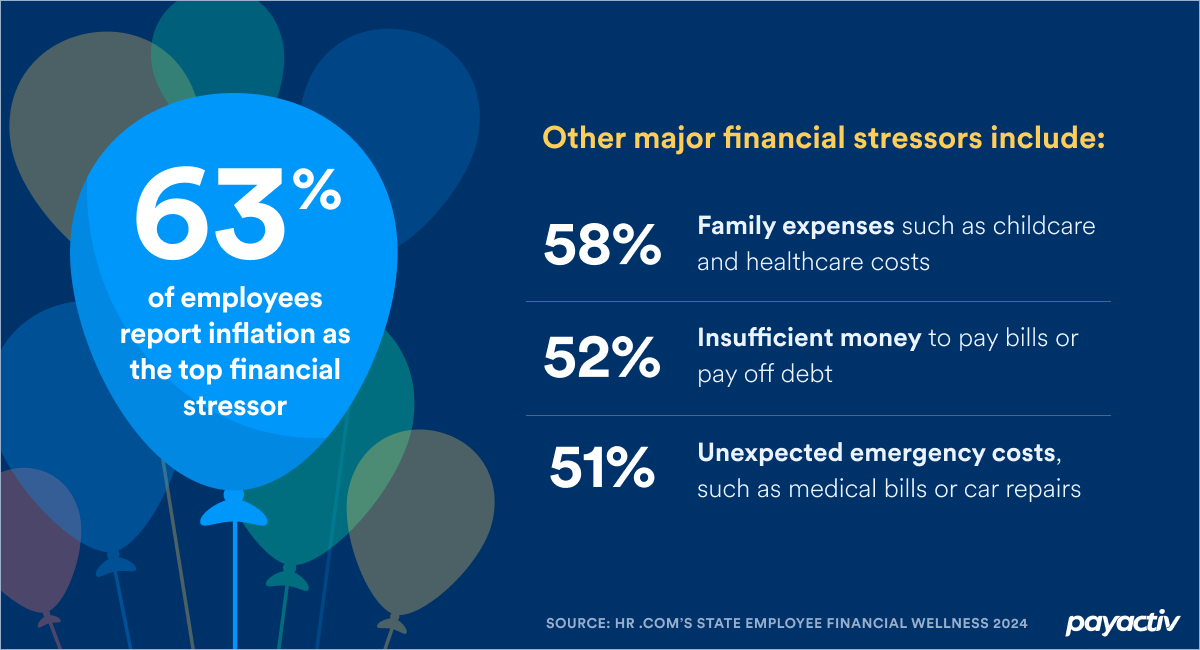

The recent surge in inflation has left employees struggling to manage their finances. According to a joint survey by HR.com and Payactiv, 63% of employees reported inflation as the top financial stressor. However, the problem goes deeper than inflation alone. Other major financial stressors include:- Family expenses such as childcare and healthcare costs.

- Unexpected emergency costs, such as medical bills or car repairs.

- Insufficient money to pay bills or pay off debt.

These stressors create a vicious cycle of financial insecurity for employees. 62% of Americans are living paycheck to paycheck. This reality leaves little room for financial emergencies or long-term savings, and the result is a workforce that is anxious, distracted, and often disengaged at work.

The Impact of Financial Stress on the Workplace

Financial stress doesn’t just stay at home. It follows employees into the workplace, resulting in decreased productivity, lower morale, and higher absenteeism. According to the HR.com and Payactiv survey, only 19% of HR professionals said their organizations fully understand the financial well-being of their employees. This lack of awareness means that many businesses are underestimating the significant toll that financial stress is taking on their workforce.

When employees are preoccupied with their finances, their ability to fully engage in their work diminishes. The stress leads to fatigue, distraction, and reduced focus. In the long run, it can even drive employees to seek second jobs, rely on expensive credit options, or, in some cases, leave their current employer in search of better financial stability elsewhere. As a result, financial stress directly affects not only individual performance but also organizational culture and retention rates.

When employees are preoccupied with their finances, their ability to fully engage in their work diminishes. The stress leads to fatigue, distraction, and reduced focus. In the long run, it can even drive employees to seek second jobs, rely on expensive credit options, or, in some cases, leave their current employer in search of better financial stability elsewhere. As a result, financial stress directly affects not only individual performance but also organizational culture and retention rates.

Solutions for Empowering Employee Financial Well-Being

Addressing employee financial stress is no longer a luxury—it's a necessity. Organizations are turning to comprehensive financial wellness programs to help their employees build resilience in the face of economic uncertainty. These programs are designed to alleviate financial stress and foster a more engaged, and productive workforce.

Here are a few key solutions that businesses are implementing:

-

Earned Wage Access (EWA)

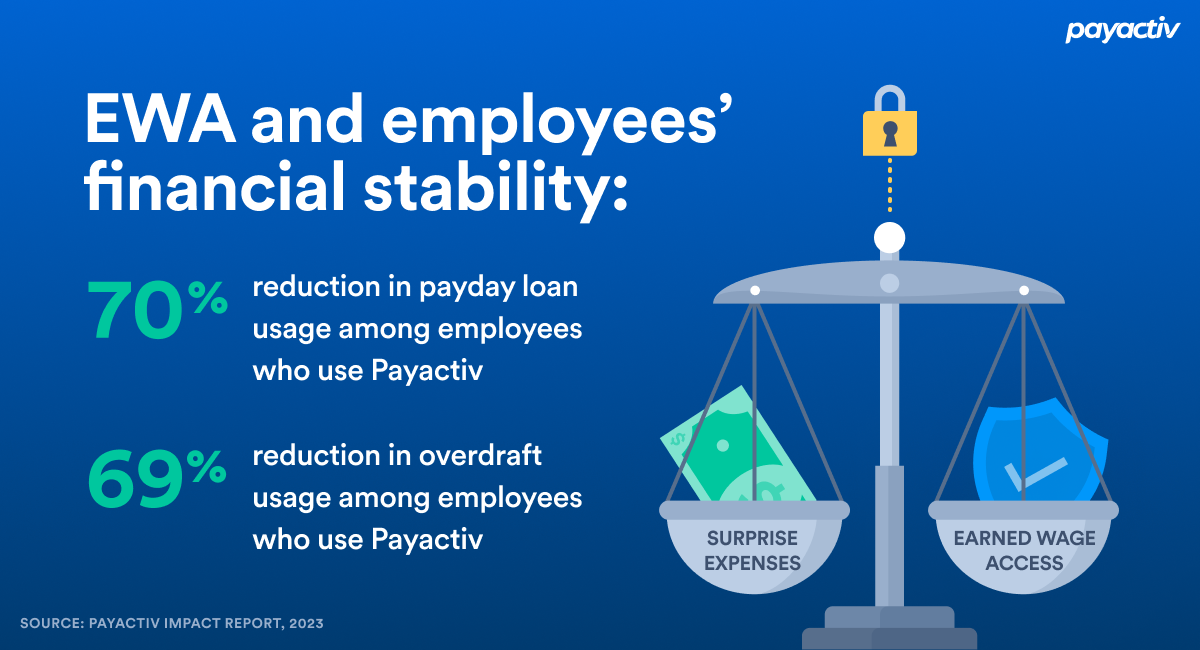

One of the most effective tools for reducing financial stress is Earned Wage Access (EWA) [1]. This solution allows employees to access a portion of their wages before their payday, giving them the flexibility to manage unexpected expenses or pay bills on time. According to Payactiv's 2023 Impact Report, companies that have implemented EWA have seen significant improvements in their employees’ financial stability:

- 70% reduction in payday loan usage among employees who use Payactiv.

- 69% reduction in overdraft usage.

These results show that by giving employees access to their earned wages, organizations can help them avoid high-interest credit options, reduce financial strain, and increase overall financial well-being.

-

Financial Coaching and Budgeting Tools

Another critical component of a financial wellness program is 1:1 financial coaching. These personalized coaching sessions offer employees expert advice on managing their money, setting financial goals, and developing smart saving strategies. By offering tailored financial support, employers can empower their workforce to make more informed financial decisions.

In addition, budgeting tools can provide employees with practical, hands-on ways to track their spending, plan for upcoming expenses, and make adjustments to their financial habits. These tools are often integrated into financial wellness platforms, making them easily accessible to employees. When combined, financial coaching and budgeting tools can significantly reduce the anxiety associated with managing personal finances.

In addition, budgeting tools can provide employees with practical, hands-on ways to track their spending, plan for upcoming expenses, and make adjustments to their financial habits. These tools are often integrated into financial wellness platforms, making them easily accessible to employees. When combined, financial coaching and budgeting tools can significantly reduce the anxiety associated with managing personal finances.

The Benefits of Comprehensive Financial Wellness Programs

The benefits of implementing a robust financial wellness program go beyond improving individual well-being. These programs have a measurable impact on company performance, retention, and culture. According to data from Payactiv, 75% of employees reported that Payactiv’s services helped them cope with inflationary pressures. This level of support leads to:

- Improved job satisfaction and morale: Employees who feel financially secure are more engaged and motivated at work. Their overall happiness increases, which translates to higher productivity.

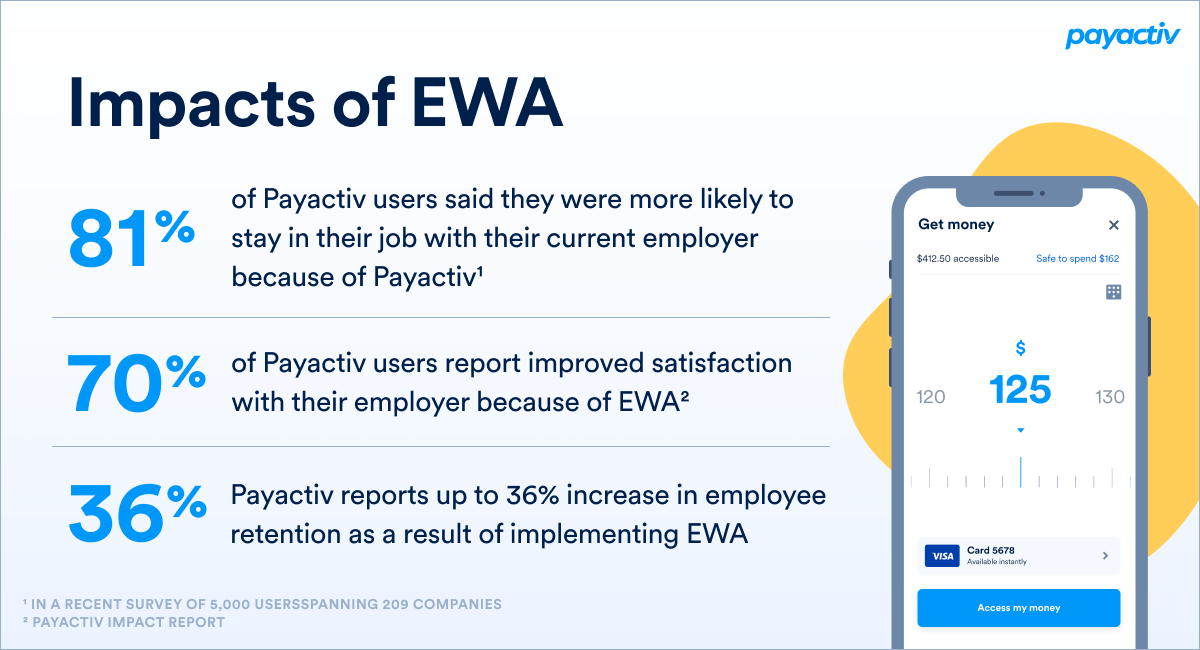

- 81% of Payactiv users said they were more likely to stay in their job with their current employer because of Payactiv (In a recent survey of 5,000 users spanning 209 companies).

- Stronger employer-employee relationships: When employers invest in their employees’ financial well-being, they foster a sense of trust and loyalty.

- 70% of Payactiv users report improved satisfaction with their employer because of EWA (Payactiv Impact Report).

- Reduced turnover: Financial stress is a significant factor in employee turnover. By addressing this issue head-on, organizations can reduce the likelihood of losing valuable employees to financial instability.

- Payactiv reports up to 36% increase in employee retention as a result of implementing EWA.

Building a Resilient Workforce

In today’s challenging economic climate, financial wellness programs are no longer optional—they are essential. As more employees struggle with inflation, family expenses, and financial insecurity, the need for comprehensive solutions becomes increasingly urgent. Programs that offer comprehensive benefits that include Earned Wage Access, financial coaching, and budgeting tools are empowering employees to take control of their finances, reduce their reliance on costly credit options, and ultimately, build financial resilience.

For businesses, investing in employee financial well-being is not just an act of goodwill—it’s a strategic move that can enhance productivity, improve morale, and increase retention. In the long term, fostering a financially secure workforce leads to a more positive workplace culture, stronger employer-employee relationships, and a healthier bottom line.

For businesses, investing in employee financial well-being is not just an act of goodwill—it’s a strategic move that can enhance productivity, improve morale, and increase retention. In the long term, fostering a financially secure workforce leads to a more positive workplace culture, stronger employer-employee relationships, and a healthier bottom line.

Watch our webcast as we dig deeper into this topic! Here we discussed real-world strategies to tackle financial stress in the workplace and boost retention, productivity, and engagement.

Click here to watch the recording and discover how Norman Regional Health System introduced financial wellness programs that made a big impact when it mattered most!

Notes

[1] Earned Wage Access requires employer participation. Employees can only access a portion of the wages they have earned to date.

Author Bio

|

Janet Sutherby is the Director of Human Resources at Payactiv. |

Error: No such template "/CustomCode/topleader/category"!