What U.S. Employers Need To Know About Rapidly Evolving State And Local Regulations

Top 5 employer regulations to note

To help HR professionals keep up with the latest, here are the top five employer regulations advancing with state and local governments across the U.S., along with suggested next steps you should keep in mind as these laws advance:

1. Sexual Harassment Prevention

2. Evolving Drug Law

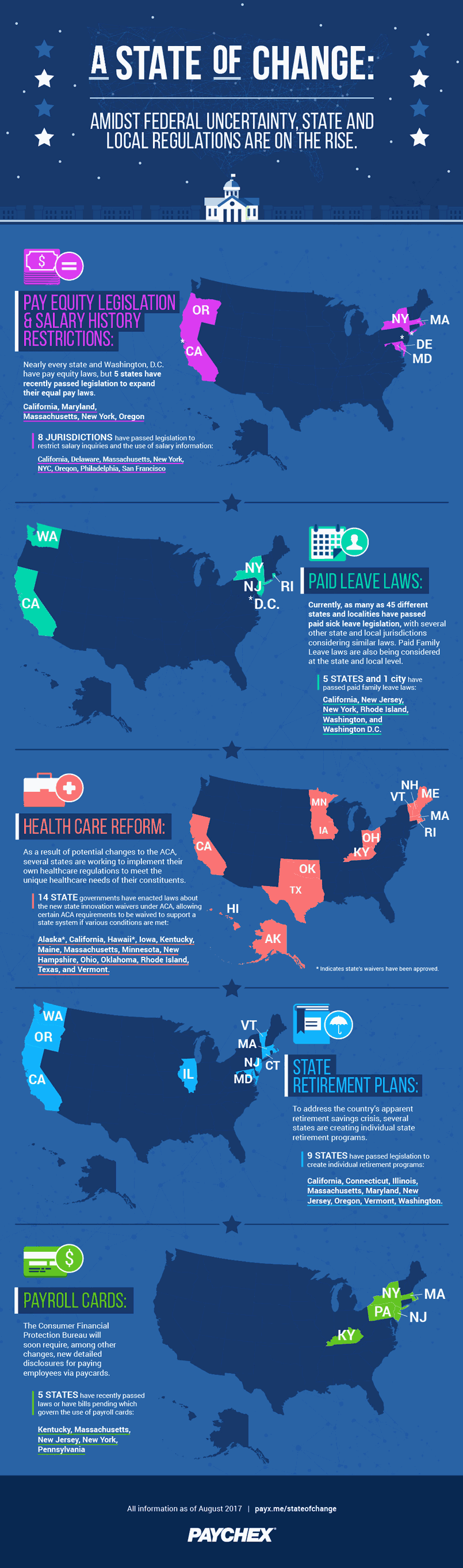

3. Paid Leave Laws

What now? Employers should plan ahead so they’re not caught off guard if an employee takes leave. This includes understanding how to navigate the process, coordination with other leaves, what to document, what questions to ask, and contingency planning to manage the employees left behind.

4. Health Insurance

As part of the Tax Cuts and Jobs Act of 2017, the federal individual mandate penalty was made zero beginning in January 2019. States were concerned that this change would correlate to premium increases and decreased coverage levels in the individual market, so some began considering a state-level individual mandate as a preventative measure. New Jersey, Vermont and the District of Columbia joined Massachusetts in enacting an individual mandate law, with Massachusetts enacting its individual mandate law in 2006 prior to the Affordable Care Act (ACA). Vermont’s law requires that many of the constructs of how the individual mandate will function, including the penalty/enforcement mechanism, be enacted during the 2019 legislative session prior to its effective date in 2020.

What now? Employers should be aware of how a state- or district-level mandate may affect employee demand for health insurance coverage, especially in the current tight labor market where benefits are increasingly important to employees and candidates. Self-insured employers also need to be aware of state-specific health insurance coverage reporting requirements.

5. State Retirement Plans

According to Paychex research, more than half (53 percent) of small business owners don’t have a formal retirement savings program at their business. Several states have acted to combat this retirement savings gap by establishing state-facilitated savings programs using one of four models: auto-IRA, multiple employer plan (MEP), marketplace, or voluntary payroll deduction IRA. Currently, 10 states, including California, Connecticut, Illinois, Maryland, Massachusetts, New Jersey, New York, Oregon, Vermont, and Washington, have enacted legislation to implement a retirement savings program for private sector workers.

What now? An additional 31 states, including Arizona, Georgia, Kansas, Pennsylvania, and Texas, are conducting studies or have proposed legislation to create a retirement savings program to support workers. Knowing they’ll likely have to provide some type of retirement plan for their employees, employers must weigh the benefits of relying on state-sponsored plans or offering a more traditional plan of their choosing.

Whether at the federal, state, or local level, keeping up with regulations is a challenge for today’s HR managers. Employers should consider leaning on their payroll and HR solutions providers who have compliance expertise in evolving areas of employment law. To view an infographic highlighting which states and municipalities are taking legislative action on the topics above – those with both passed laws and ballot initiatives.

Note: The information contained within is not legal advice. These issues are complex and applicability depends on individual circumstances. Businesses should consult legal counsel before taking action on any of the items identified above.

Author Bio

|

|

Mike Trabold is the Director of Compliance Risk for Paychex, Inc. |

Error: No such template "/CustomCode/topleader/category"!