Vish, congratulations on recently marking your third anniversary at Mercans—and more than 30 years in the payroll and HR tech industry. Could you take us through your professional journey?

Vish, congratulations on recently marking your third anniversary at Mercans—and more than 30 years in the payroll and HR tech industry. Could you take us through your professional journey?Vish: “Thank you — it’s been a meaningful milestone, both personally and professionally. When I look back on my journey, the defining theme has been this unusual but incredibly powerful transition: I started out as an entrepreneur, and then became an employee. That’s the reverse of how most careers evolve, and I believe that switch has been the bedrock of my success over the past three decades in the payroll and HR tech space.

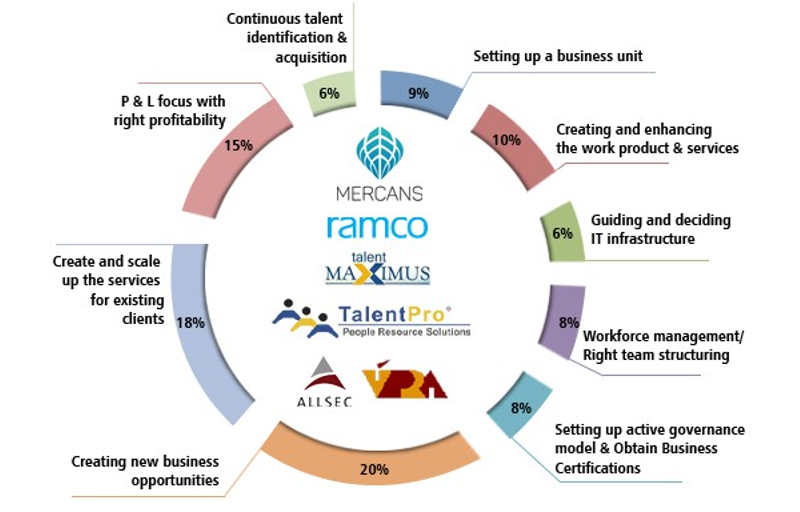

Right after college, as early as 1995, I founded Vipra Software along with Raju and Prakash — with no external backing, just our own money, vision, and willpower. We built the company from the ground up, launched multiple payroll-related software products, served over 300 clients, and eventually sold the business to Allsec as part of the successful M&A. That entrepreneurial phase was my real-world MBA. It taught me not just how to run a company, but how to live inside a P&L mindset — where every $, every resource, and every decision had to deliver value. By the way, the company is still using the powerful payroll engine that we built and is benefitting from the same.

When I transitioned into corporate roles — first at Allsec, then at ProLease (US based firm), Talent Maximus, Ramco Systems, and now at Mercans — I carried that entrepreneurial DNA with me. Most employees grow into ownership thinking over time; for me, that mindset was already hardwired. I never saw myself as a cost center. Wherever I went, I built business units that stood on their own legs — profitable, lean, and self-sufficient. I never expected the founder to fund my function, and I think that’s made a big difference in how I’ve scaled operations and built trust at leadership levels and across all the clients.

At Ramco, I started their payroll managed services business from scratch, grew it to $10M+ in annual revenue, expanded across geographies, and ultimately helped shape their global services vision using the product. Then, I joined Mercans three years ago, I began as COO, transitioned into the CEO role within 10 months, and took on the position of Executive Director 14 months back. One of the first milestones we achieved was being recognized by NelsonHall as a payroll technology leader within just Six months of my arrival. While Mercans already had a solid product, I worked closely with the team to increase its visibility and make key improvements, which helped establish the company as one of the most trusted solutions in the market.

I’ve focused on driving a product-led, scalable approach, particularly through our Gross-to-Net Payroll Engine and the integration of automation using AI and ML. As a result, we’ve seen 3x revenue growth, expanded our global partnerships, and laid the groundwork for future growth and long-term objectives, including IPO readiness.

In a way, my career has been about proving that entrepreneurial grit and corporate scale don’t have to be opposites — they can power each other. From building software in a two-room office to leading 600+ people across the globe, it’s been an incredible ride. And the mission continues.”“In today’s fast-paced business world, success isn’t about reinventing the wheel—it’s about leveraging the tools and resources available to you, being agile, and continuously adapting to meet the evolving needs of your customers. Focus on building scalable, user-centric solutions and surround yourself with a team that’s aligned with your vision. When you do this, the growth will follow.”

With over 30 years in the industry, what major shifts have you seen in payroll, and how did your early SaaS work help shape its evolution?

With over 30 years in the industry, what major shifts have you seen in payroll, and how did your early SaaS work help shape its evolution?Over the past 30 years, I’ve witnessed payroll transform from a back-office afterthought into a mission-critical business function. When I started in the mid-90s, payroll was treated like a freebie—it was often a college project or a throw-in freebie module from large ERP providers. Nobody saw it as a serious industry, let alone a career path. But I saw its potential early on and decided to focus entirely on payroll. I never deviated from that path.

Back then, we built and sold our own payroll product at Vipra Software, a company I founded at the age of 24. What’s interesting is that without realizing it, we were already doing something close to SaaS—users could buy a ₹200 demo on floppy disks, set up their own company, and run payroll for 5 employees—all without any support. It was a self-service model, long before SaaS was mainstream.

A turning point came when a client—a newspaper publisher—suggested we stop thinking of payroll as software and start thinking of it as a service. At the time, I laughed it off. But he was right. Payroll was always meant to be a repeatable, compliance-heavy, process-driven service. That insight stuck with me, and over time, it became the foundation for how I built and scaled managed services around SaaS platforms. I can proudly claim that i was there to witness how the payroll industry transformed from Software to Service and to Software now.

The key shift I’ve seen is this: payroll has gone from being perceived as non-core to becoming deal-critical.

As for SaaS, we moved from on-prem systems that required massive IT support to cloud-native, API-driven platforms where customers can configure complex logic without writing a line of code. That philosophy—empower the end-user, reduce IT dependency, collect data only once at the source—has stayed with me since day one.

So in many ways, I’ve lived the payroll journey—from floppy disks deployment to AI-driven engines on SaaS model —and I’m proud that the principles we believed in early on have shaped not just the tools we built, but the direction of the industry itself.

What principles have made early payroll engines so enduring?

What principles have made early payroll engines so enduring?Vish:

The enduring strength of early payroll engines—especially the ones we built at Vipra—came down to a few foundational principles that I still stand by today.

The first was user empowerment. From the very beginning, we believed the system should be configurable by the end-user without needing technical help. So we built a formula builder that mimicked the functions of Excel and Visual Basic functions. This allowed users to create their own salary structures, compliance logic, and rules—no coding required. That thinking has evolved today into what people call “low-code/no-code” platforms, but we were doing it back in the late 90s.

Second, we focused heavily on input flexibility and automation. Long before the flexible input model that is available today, we enabled clients to send payroll input in any format they preferred. Our system would map and store their templates, so they never had to enter data twice. That reduced errors and saved time—critical in high-volume processing.

Third, we made speed and accuracy non-negotiable. Our engines could run payroll multiple times a day—a necessity for clients who needed rapid corrections and validations. We built in pre-configured compliance checks and generated the statutory files needed for things like PF and income tax filings.

Another core principle was this:

“Data should be collected at source only once. After that, the data should keep moving through the system without re-entry / modification.”

This reduced duplication, minimized human error, and made issue tracing simple.

Lastly, we had a mindset of accessibility and trust. We sold demo versions for ₹200 via floppy disks, letting clients try before they committed. And they loved it. We didn’t just give them a tool—we gave them confidence on the product. That confidence is what built long-term customer relationships and kept our products in use for years.

These principles—user-first design, flexibility, performance, automation, and trust—are what made those early engines not just functional, but future-ready, even decades ago.From founding Vipra to leading roles at Allsec, Prolease, Talent Maxius, Ramco, and now Mercans, how have your leadership philosophies evolved over the years?

Vish:

If I look back at my leadership journey—from founding Vipra, to roles at Allsec, Prolease, Talent Maximus, Ramco, and now Mercans—what’s interesting is that while the environment around me changed, my core leadership philosophy remained constant and only got sharper over time.

At Vipra, as a young entrepreneur, I didn’t have formal training—I led with instinct, trust, and deep involvement. We had no cabins, no hierarchy. Everyone sat together, worked together, and owned the mission. That flat, agile, team-first mindset shaped everything I do, even today. I strongly believe in transferring confidence to people—whether it’s customers or teams. If they feel ownership and trust, they’ll go far beyond your expectations.

Over the years, I’ve also learned that you don’t hire perfect people—you nurture them into aligned performers. My strength has always been reading people’s strengths and creating the right environment for them to thrive. Most of my early teammates at Vipra and other companies where i worked are still stay in touch with me and connected. That speaks more than any title or KPI ever could.

Another principle I hold tightly is “know when to stop.” I exited Vipra not because it failed—it was growing—but because I saw the funding constraints ahead. That clarity of timing and self-awareness allowed me to move forward rather than break down. It’s something I’ve carried into my corporate leadership—not just chasing growth, but knowing how and when to pivot. Funding as a process is a must for any business and it was a good learning for a first generation businessmen like me.

At Ramco, I built the payroll services division from scratch and ran it with the same entrepreneurial fire—clear focus on P&L, scale, automation, and customer-centricity. And at Mercans, that mindset helped me grow from COO to CEO and now Executive Director. I came in with the same belief: this is my business.

So if I had to summarize, my leadership style evolved not by changing principles, but by maturing how I applied them. From gut-led to insight-led. From trusting my instincts to also building scalable systems around that trust. But at the heart of it, it’s still about trusting people, enabling automation, transferring belief, and knowing when to move forward—or move on.What drove your rapid rise—from COO to CEO and board member within a short span at Mercans?

Vish:

It may have looked like a rapid rise from the outside—from COO to CEO to Executive Director—but for me, it was a natural extension of how I’ve always operated. I came into Mercans with an entrepreneur’s mindset, not as an employee waiting to be told what to do.

From day one, I treated the business as if it were my own. I wasn’t just focused on operations and delivery—I was constantly thinking about the P&L, about how to make us more product-driven, about how to differentiate globally, and where the growth engine should come from. That mindset shaped every action I took.

Very early on, I worked to reposition Mercans as a payroll technology company. One of the first outcomes was being recognized as a leader by a well established analyst firm, which was a strategic branding effort I led personally. Internally, I focused on building our Gross-to-Net payroll engine, integrating AI/ML validation layers, and scaling the implementation model to improve profitability.

But if I had to give a simple answer, it’s this:

I didn’t wait for authority to be handed to me—I took ownership from the start.

When leadership sees that you’re not just managing a function, but thinking about the entire business, growth naturally follows.

And to be honest, I don’t see it as an achievement. I see it as alignment—my mindset and the company’s vision clicked. That synergy is what made things move quickly.In today’s increasingly digital and global business environment, how do you see payroll transforming over the next 5 to 10 years?

Vish:

In the next 5 to 10 years, I see payroll evolving into something far more intelligent, fluid, and deeply integrated into the broader digital and financial ecosystem. It will no longer be a static, back-office function—it’ll behave more like a real-time calculator, available on-demand, personalized to the individual, and capable of supporting a highly flexible, global workforce.

The very nature of work is changing. We’re moving away from traditional long-term employer-employee models to project-based, multi-employer, and remote-first engagements. With that, payroll systems will need to support dynamic earning structures, flexible taxation, and social security compliance across borders.

I believe the future lies in daily accrual-based payroll engines—where compensation is tracked and accrued in real time. Imagine this: as you complete work each day, your earnings accumulate. Banks and fintech platforms can then step in, offering salary advances or financial products based on what you’ve already earned. This creates a powerful ecosystem where payroll isn’t just about disbursing salaries—it becomes a credit engine, a financial gateway, and a trust signal.

From a tech standpoint, AI and ML will help predict earning trends, creditworthiness, and risk based on payroll data. And instead of opaque processes, we’ll have shared, transparent engines—where both the employee and employer use the same calculator. This ensures accuracy, removes misunderstandings, and allows employees to simulate and understand their net pay, deductions, and entitlements ahead of time. It’s not just automation—it’s empowerment.

But none of this works unless your core payroll design is rock solid. I often say: tech is just the vehicle.

So yes, we’ll see a future where payroll is embedded into fintech, accessible via APIs, and event driven processing. That’s where we’re headed.With your technical background, how do you strike a balance between innovation and operational stability in payroll solutions?

Vish:

With my technical background, I view technology as a vehicle—it doesn’t drive outcomes on its own. What truly drives results, especially in payroll, is the strength of your fundamentals. If your basics are clear and your functional design is sound, then technology can help reduce manual effort, improve accuracy, and increase efficiency. But without that clarity, technology becomes ineffective.

I strongly believe that no technology can work without an event or a reference—it always needs something to act upon. Whether it’s a payroll input or a business trigger, the system must be anchored in well-defined functionality. That’s why I focus first on understanding what needs to be achieved, and only then decide how technology can support it.

To explain this, I once gave the example of traveling from Chennai to Delhi. The destination is fixed, but you can choose to walk, cycle, drive, or fly—each is a different technology. The choice depends on your purpose, constraints, and readiness. If you’re on a pilgrimage, walking may be the goal itself. But if speed and efficiency matter, you might choose to fly—with all the planning and cost that involves.

So, for me, balancing innovation and operational stability means ensuring that business functionality leads the way, and technology follows as an enabler. Innovation is most effective when it is layered over a strong, well-understood foundation.As someone who’s built products from the ground up, what advice would you give to today’s entrepreneurs developing next-gen HR or payroll tech?

“Building HR and payroll tech from the ground up is an exciting journey, but it’s also a complex one, especially in today’s fast-moving digital landscape. My advice is simple—don’t reinvent the wheel, but innovate around what already exists.

First, embrace the tools and platforms available to you today. There is an incredible ecosystem of ready-made solutions, libraries, and components that can accelerate your development process. The challenge is no longer about building everything from scratch but about understanding how to combine and integrate these tools effectively to create something unique.

Focus on creating a solid design from the outset, a clear vision of what you want your product to achieve. Once that design is in place, use the tools at your disposal—be it no-code platforms, SaaS solutions, or APIs—to build the infrastructure and scale it without diving into the complexity of manual coding.

Today’s entrepreneurs are fortunate to have access to a wealth of resources and tools that we didn’t have when we started. The key is to use them smartly. For example, payroll systems are no longer just about managing salaries; they are about integrating benefits, compliance, and data security, all while providing a seamless experience for users. A good product should be user-centric, easy to navigate, and be able to adapt quickly to market and regulatory changes.

And most importantly, speed matters. The tools and resources available today can allow you to achieve your goals far faster than before. Whether it’s about saving time, cutting costs, or improving efficiency, the ability to get to market quickly will be a major advantage.

In my view, the digital tools you use today are your best allies in crafting a product that serves the needs of modern businesses and employees alike. So, don’t overcomplicate things. Take the time to understand the available technologies, integrate them, and build a product that meets the real demands of the market. By leveraging what’s already available, you save time, money, and resources, and can focus on what truly matters: solving your users’ pain points.”

Vishwanathan Arunachalam, Executive Director & Chief Executive Officer at Mercans - Payroll & SaaS BusinessLearn more at www.mercans.com

Vishwanathan Arunachalam, Executive Director & Chief Executive Officer at Mercans - Payroll & SaaS BusinessLearn more at www.mercans.com